The International Energy Agency estimates that Iran�s oil exports fell to 1.6 million barrels per day (mb/d) in September, down 800,000 bpd from a recent peak in April at 2.4 mb/d. The losses are expected to continue, but few analysts really believe the Trump administration will manage to cut Iran�s exports to zero.

According to�Reuters, �an unprecedented volume of Iranian crude oil is set to arrive at China�s northeast Dalian port this month and in early November before U.S. sanctions on Iran take effect.� An estimated 20 million barrels are destined to flow from Iran to China over the next few weeks, up from the usual 1 to 3 million barrels each month.

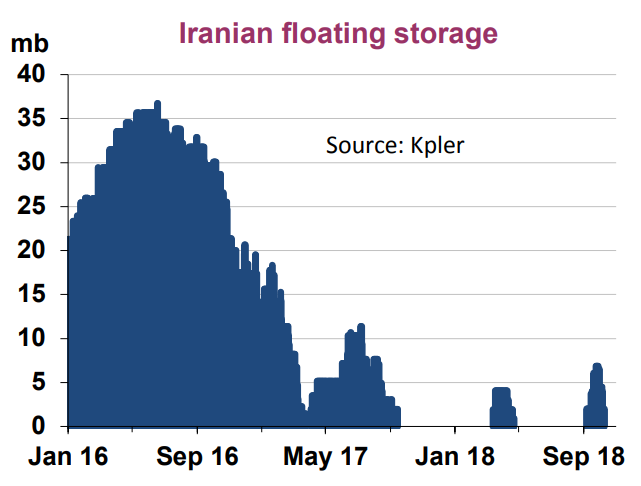

Other data from the IEA backs up this trend. Iran has been storing a portion of its oil production on ships in the Persian Gulf, a practice that it resorted to during the previous period of international sanctions between 2012 and 2016. It is difficult to simply turn off oil production, and with onshore storage filling up, Iran has been forced to store oil at sea. However, while Iran�s floating storage spiked in September, it actually fell back in October, �as several cargoes set sail for China and India, data from Kpler showed,� the IEA wrote in its report.

The surge in shipments demonstrates Iran�s determination to keep its oil flowing. �As our leaders have said it will be impossible to stop Iran from selling its oil. We have various ways of selling our oil and when the tankers reach Dalian, we will decide whether to sell it to other buyers or to China,� a source from the National Iranian Tanker Company (NITC) told Nick Cunningham

Meanwhile, there is other evidence to suggest that Iran is succeeding in shipping much more oil than is officially reported. NITC tankers have shut off their tracking devices in order to keep up oil shipments in the dark. Some�satellite data suggests�that a greater number of tankers are heading to India that is thought to be the case. The IEA said in its October Oil Market Report that India�s purchases from Iran jumped from 390,000 bpd in August to 600,000 bpd in September.

The furtive shipments from Iran to India demonstrate the limits of U.S. power. Discounts, off-the-books shipments, bartering and other clandestine maneuvers should keep some Iranian oil flowing even after November 4. For instance, Iran has�discounted�its oil by the most in 14 years, according to Bloomberg, making it hard to pass up for would-be buyers.

Still, Iran�s oil exports have indeed suffered a significant blow from the looming sanctions. China�s imports from Iran fell to 430,000 bpd in September, the lowest amount since 2016. Sinopec�s trading unit, Unipec, has said that it slashed the amount of oil it is buying from Iran because of pressure from the United States. Europe purchased 420,000 bpd in total in September, down 240,000 bpd from the second quarter. These volumes, in particular, are likely most at risk as European companies are much more intertwined with the United States, and as such, are vulnerable to American sanctions

The U.S. has repeatedly vowed to take Iran�s oil exports to zero, and has maintained that any waivers would be �few and far between,� as National Security Advisor John Bolton put it. However, the U.S. is also in talks about waivers with countries that depend on Iranian oil, such as Turkey and India. The Trump administration is in somewhat of a bind, as cutting Iran�s oil exports by too much will drive up crude oil prices, which could be a political liability at home.

The flip side of this is the possibility of a release from the U.S. strategic petroleum reserve (SPR). In fact, it is somewhat surprising that this has not already happened. The loss of supply from Iran and the sudden tightness in the market would offer some justification for an SPR release, Jason Bordoff of Columbia University's Center on Global Energy Policy said in an interview with�S&P Global Platts.

An SPR release is a one-off affair, and many analysts � and even the U.S. Secretary of Energy Rick Perry � have said that it would do very little to ease a supply shortage. However, it would have a significant psychological impact on the market, suppressing prices in the short run while also giving the Trump administration more leeway to take a harder line on countries buying oil from Iran.

Nevertheless, the U.S. is going to have to swallow some bit of cheating because Iran�s oil exports are unlikely to fall to zero over the next few weeks.