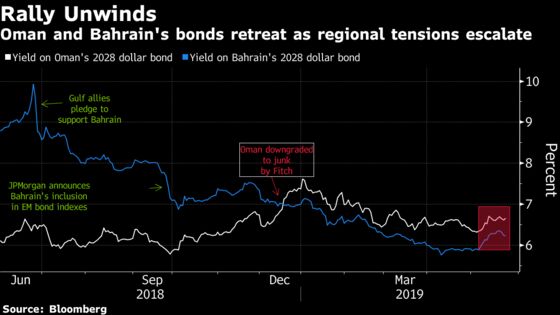

Bloomberg |†Netty Idayu Ismail: Bahrain and Oman may have missed a golden opportunity to lock in cheap foreign financing. Ever since tensions between Iran and its Arab neighbors began boiling over this month, the countriesí bonds have been leading losses across the six-nation†Persian Gulf Cooperation Council. The sell-off is unwinding gains that pushed the yield on Bahrainís 10-year dollar debt to an all-time low in April , and that on Omanís equivalent note to a six-month low earlier in May.

If the rout has legs, the higher borrowing costs could strain the nationsí public finances, already considered the weakest in the region. Oman risks slipping deeper into junk-level credit ratings, while Bahrainís ability to eliminate a budget deficit remains a challenge, according to S&P Global Ratings. The island kingdom plans to return to international bond markets this year for the first time since its†Persian Gulf allies pledged a $10 billion aid package.

Omani and Bahraini bond spreads arenít likely to get any tighter than the lows hit earlier this year, said Abdul Kadir Hussain, the head of fixed-income asset management at Arqaam Capital Ltd. in Dubai.

Adding to the headwinds that Bahrain and Oman face as the market turns against them, is their complicated relationship with Tehran. The U.S. stopped granting waivers to buyers of Iranian oil this month, tightening sanctions imposed on the Islamic Republic, and investors have balked at the prospect of escalating tensions in the region.

Oman has in the past facilitated talks between Iran and the U.S., while Bahrain, a small Sunni-ruled island nation, has regularly accused Tehran of stirring dissent in its Shia-majority population.

GCCís Laggards

Debt issued by Oman and Bahrain has lost about 1% since the end of April, the most in the region. In comparison, returns on GCC bonds as a whole have been flat, according to Bloomberg Barclays indexes.

The yield on Omanís dollar bond due January 2028 was trading at 6.7% on Monday, about 40 basis points above a low touched on May 3. Bahrainís bond maturing October 2028 was yielding 6.23%, almost 50 basis points higher than an all-time low of 5.76% on April 9.

Franklin Templeton Investments has already cut its exposure to the nationsí bonds, according to Mohieddine Kronfol, the Dubai-based chief investment officer for global sukuk and fixed income for Middle East and North Africa. Oman is the only GCC economy that is ďon a deteriorating trajectoryĒ and Bahrain needs to put its austerity plan into action, Kronfol said in an interview earlier this month.

QR code

QR code