Bloomberg |Alex Longley, Grant Smith and Christopher Sell: Global markets for equities, currencies and metals have all been whipsawed by the uncertainty over what President Donald Trump’s next geopolitical move would be. Oil’s about to have a turn.

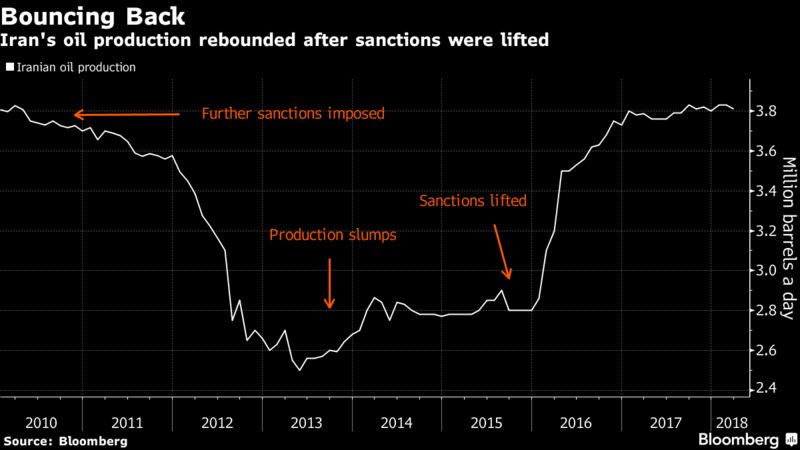

It’s too close to call whether Trump will reinstate sanctions on Iran next month and the impact is highly uncertain, according to a Bloomberg survey of oil-market analysts. The 17 respondents saw on average a 50-50 chance of sanctions “snap-back,” which could halt anywhere between zero and 800 thousand barrels a day of exports from OPEC’s third-largest producer within the next six months.

That risk looms over Friday’s meeting of some OPEC nations and their allies as they gather to monitor supply cuts in Jeddah, Saudi Arabia.

The possibilities for Trump’s next move -- and the global response -- are wide-ranging. He could choose to reinstate punitive measures when the sanctions waivers are next due for renewal on May 12 , but also has the ability to soften -- or even harden -- the regime.

Under his predecessor Barack Obama, countries could avoid having their banks or companies blocked from the U.S. financial system by showing they were curbing imports from the Persian Gulf. It’s less certain whether Trump would take the same approach if sanctions snap back, or how much global support such a move would generate. He could in theory impose penalties on any country that buys Iranian crude.

As analysts caution that the road ahead may be volatile and unpredictable, here’s what some of the biggest names on Wall Street and beyond have to say on the issue:

Citigroup

“The fact that there’s been a change of personnel in both the White House and the State Department pushes the probability up. It would have some impact on price, in the third and fourth quarters, on a couple-of-dollar basis. It’s a good even bet that it will or will not happen in May.”

-- Ed Morse, global head of commodities research

JPMorgan

“I wouldn’t say it’s definitely going to happen, but the probability is very high, especially after U.S. tightened sanctions on some Russian entities recently. Our average for the second quarter was $75 but our high-case scenario was $80. In a case where Iran tensions escalate, then you will obviously see prices trend towards those levels.”

-- Abhishek Deshpande, head of oil market research and strategy

RBC Capital Markets

“It’s certainly well above 50 percent, it’s more likely than not. It firms the case for the Brent-at-$70-plus story. With Bolton, I think we go beyond the discussion of sanctions -- are we going to start thinking about regime change in Iran?”

-- Helima Croft, chief commodities strategist

BNP Paribas

“If we were to assign a probability of President Trump not signing waivers come mid-May, it would be above 60 percent. We would assume that only up to half the impact of the previous sanctions regime may be achievable in the case of a snap-back of U.S. sanctions, or something in the order of up to 500 thousand barrels a day.”

--Harry Tchilinguirian, head of commodity markets strategy

ING

“With the appointment of Bolton, I think it really tells you the direction we are going. If we see the U.S. follow the same procedure as last time, I think we may only start to see an impact on supply from November. Sentiment-wise I’m pretty sure the market will rally well above $70 in the short-term, but then we need to see what OPEC decides.”

-- Warren Patterson, commodity strategist

SocGen

“We place a 70 percent probability of Iran oil sanctions snapping back into effect on May 12, with a $10 price impact (of which $5 is already priced in). Our base case is that sanctions will take at least 2-3 months to be implemented, and will remove 0.5 million barrels a day of Iranian crude from the market, much less than in 2012.”

-- Mike Wittner, head of oil market research

HSH Nordbank

“The chance of reimposing sanctions is relatively modest, around 30 percent. It would affect several hundred thousand barrel a day of exports and at current inventory and price levels, that would add $3 a barrel.”

--Jan Edelmann, commodity analyst

The Timeline

- Trump waived sanctions on January 12, saying that it was a “last chance” for Iran; the next waiver is due on May 12

- If sanctions do “snap back” there could be a 180-day period to wind down business operations involving Iran, according to U.S. Treasury guidance, although this could be amended

- After that period, it’s likely that the measures previously exempted as part of the Joint Comprehensive Plan of Action would be reinstated, including those requiring countries to show a significant reduction in purchases from Iran

- The punishment for non-compliance would be for financial institutions to be shut out of the U.S. financial system

- However, the definition of those rules, and the timeframe in which they need to be implemented could all change if and when Trump refuses to waive sanctions, according to Richard Nephew, a senior research scholar at Columbia University’s Center on Global Energy Policy

- Finally, it’s worth keeping in mind that Trump’s measures against United Co. Rusal brought largely unexpected turmoil to global aluminum markets. That’s something to keep in mind as the deadline for waiving the Iran sanctions gets closer.